* We’re backed by Scottish Friendly Assurance Society, resulting in 99.1% of our life insurance claims being paid in 2021.

We all want the best for those we love, and with our Life Insurance, you can help make sure that your family are covered if you were to pass away unexpectedly. We’re here to help you get the cover you need to enjoy life now.

There are two types of life insurance that you can buy through Budget Insurance: Level Term and Decreasing Term (this can also be known as Mortgage Term).

With a Level Term Policy the cover amount is fixed for the length of the policy term. This means that if you pass away whilst the policy is valid, your family can claim for a set amount of money.

A Decreasing Term Policy means that the amount you are covered for reduces over time. This will mean your family will be able to claim the current value of the policy.

Your monthly payment won’t reduce on this type of policy.

Protect your family further with a will, provided free to Budget’s life insurance customers

Be sure that the people you want to receive the proceeds of your policy do

Free legal assistance for end of life matters, when your family may need it most

You can customise your policy to suit yourself or create additional cover for a partner

Additional option to cover against critical illnesses, for you and your children

A free service with help from a registered nurse if you’re diagnosed with a critical illness

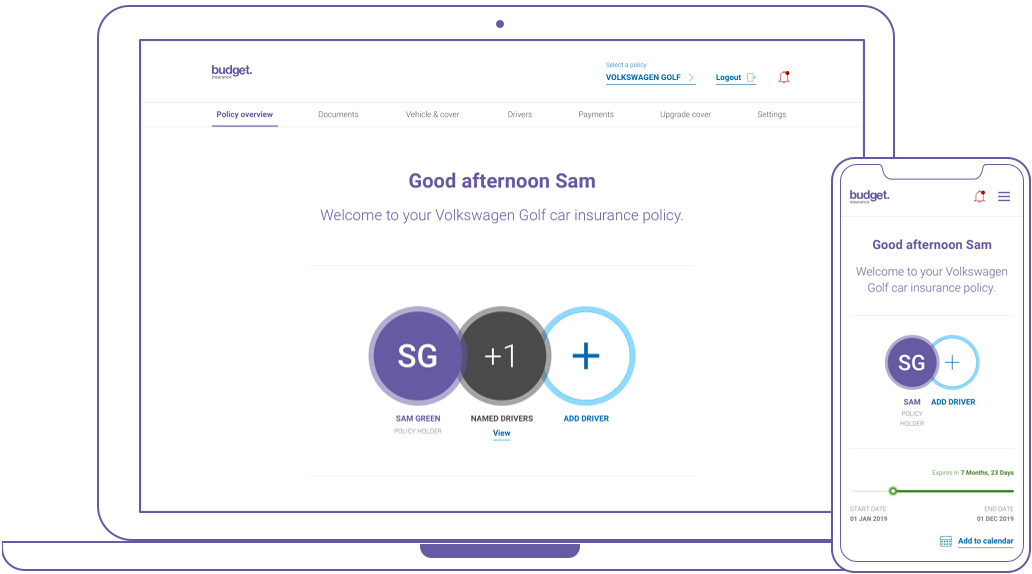

We know printed policies are likely to be misplaced and if you want to make amendments to your policy it is not always convenient to ring up a call centre. We want you to be able to look after your insurance policy in the way that suits you and at a time that is most convenient for you.

Download and view your documents any time.

We keep all of your data safe and secure.

We know printed policies are likely to be misplaced and if you want to check your policy documents it is not always convenient to ring up a call centre. Our online My Account area is a quick and easy way to maintain your documents

Why do I need life insurance or critical illness cover?

Life insurance is all about reassurance. A life insurance policy helps to provide a financial benefit to your loved ones should the worst happen.

With Budget life insurance and critical illness cover, your loved ones would receive a cash lump sum if you were to die or become too ill to work during the policy term.

What types of life insurance are available?

It’s easy to get confused when trying to understand which type of life insurance cover is better for you. We’ve tried to make it simple so that you can be confident that you purchase the right policy for you.

There two types of life insurance that we offer at Budget are:

With a Level Term Policy the cover amount is fixed for the length of the policy term. This means that if you pass away whilst the policy is valid, your family can claim for a set amount of money agreed at the beginning of the policy.

A Decreasing Term Policy means that the amount you are covered for reduces over time. This will mean your family will be able to claim the current value of the policy. Your monthly payment won’t reduce on this type of policy, but the amount that can be claimed for will.

Do you offer joint life insurance?

At Budget we provide both a Single Policy and a Joint Policy; this means that you can buy life insurance cover for both you and your partner or just for you.

At Budget you are automatically accepted and covered by Accidental Death Benefit if an immediate decision can’t be provided. This won’t cost you anything and can pay out up to £100,000 if you were to die before we reached a decision.

If you have already been accepted for a life insurance policy and a payment has been taken, you are covered immediately.

Why should I take out life insurance with Budget Insurance?

Budget not only offers great value life insurance, with cover up to £750,000.

We also understand how important it is to provide you with the highest level of support. Our UK based Customer Service Team are also on hand if you have any questions or need to make a claim – give them a call on 0330 0188806.

To make life even easier for you, we also have an online My Account available 24 hours a day, seven days a week where you can view and print all of your insurance documents.