A Budget Insurance snapshot of home and vehicle crime in the UK

#crimereport18

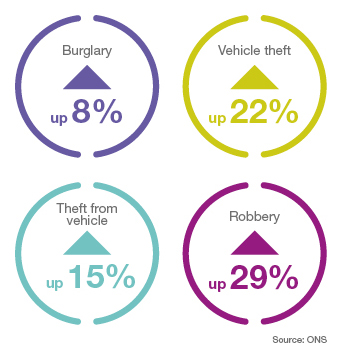

There’s no escaping the reality of burglary and vehicle crime. It happens. ONS data released in January shows an 8% rise in burglaries from 402,013 to 433,110 offences over the year to September 2017. Vehicle theft is up by 22% to 100,828, while theft from vehicles has risen by 15%. Robbery offences, too, are up by an alarming 29% compared with the previous year.2 And all of these types of crime give rise to an understandable fear.

With nearly a third (29%) admitting to losing sleep as a result, the worry about crime isn’t an insignificant issue. Over half of those polled (52%) said that they were worried about general crime in their area. And, even though this is likely to be fuelled by the fact that nearly half (46%) have actually experienced crime in the last twelve months, a staggering 73% firmly believe that crime in their area is, or might be, on the increase.

But who are the main worriers?

Interestingly, age seems to be the biggest factor in the fear of crime. Nearly two thirds (59%) of those aged 30-44 admit that crime in their local area does bother them compared to just over a third (39%) of those aged over 60.

Three quarters (75%) of 16-29 year olds and a staggering 80% of 30-44 year olds also worry that crime is on the increase in their local area. And, even more startling, they are almost twice as likely to feel afraid in their own home as the older generation (47% of 16-29 year olds and 40% of 30-44 year olds compared to 26% of 45-59 year olds and 21% of 60+ year olds).

And if we actually become victims of crime, the impact goes much deeper than worrying about the sheer prospect of it. Recent figures from the Office of National Statistics (ONS) show that 80% of people who have had their car stolen admit that they were emotionally affected by the experience. And as well as reporting feelings of annoyance, anger and shock, nearly one in five (18%) have been left feeling vulnerable and one in eight (12%) have been left with difficulty sleeping as a result.

Among those who had experienced a burglary, a similar number (82%) report being emotionally affected by the experience, with 29% affected ‘very much’. Almost a third (31%) were left feeling vulnerable or suffered a loss of confidence, while 21% experienced anxiety and panic attacks.3

Crime is not just something feared by the majority, it is something that can cause longer term emotional consequences in the form of sleepless nights and loss of confidence; whether you are worrying about the risk or a victim of the reality.

The fear of crime is real

The impact of crime is emotional as well as financial. 29% of people lose sleep worrying about the prospect and over 80% of victims of burglary and vehicle theft (ONS) report feelings ranging from anger and shock to anxiety and depression as a result.

Life is about experiences and how we deal with them.

And it seems it can take years of practice. The people least likely to fear crime in their own home are those aged 45 and above. And not surprisingly, they are the most likely age group to take precautions to protect their home in the first place.

Sixty percent of 45-59 year olds and nearly three quarters (72%) of those aged 60+ treat property security as a priority. This is not to say that they are overly nervous about the threat of crime. Quite the contrary. The older generation simply sees the benefit in protecting themselves and, their property, as a precaution.

This group accepts that crime exists. In fact, the majority (72%) aged 45-59 believe that crime in their local area is on the increase. But proactivity and preparation mean that they are less likely than their younger counterparts to spend time worrying. You might never experience a crime. But if you do, at least you are prepared.

By contrast, over half (54%) of those aged 30-44 admit that they aren’t always vigilant about the risk of crime (vs 28% aged 60+). It seems this age group has enough on their plates, without adding property security and crime prevention to the list.

It’s probably fair to say that the older you are, the more accepting of crime you are. You accept it as a part of life and you gain the experience (and inclination) to prepare against it.

The more prepared you are, the less you worry; 82% of this cautious generation – those aged 60+ – have never lost sleep worrying about crime. The 16-29 year olds, on the other hand, were far more likely to worry, with over one third (38%) admitting to losing sleep, thanks to their concern.

Almost half of this age group (47%) have admitted to feeling afraid in their own home: a stark contrast to those aged 60+, where only one in five people feel the same. In summary, the younger generation is more fearful of crime yet less likely to take proactive measures to protect themselves against it.

But with an abundance of quick fixes out there, the simple steps can make a big difference. Remembering to close all windows, lock every door and keep valuables out of sight are just a few ways to reduce temptation and therefore feelings of vulnerability.

Older and wiser

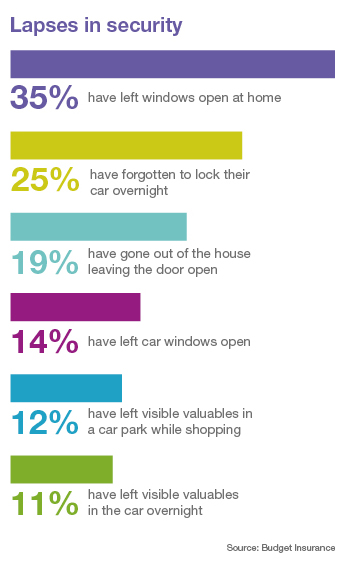

The trouble is, security isn’t high on today’s agenda. A whopping 52% of all vehicle-related theft, in 12 months, was due to a door being unlocked or a window being left open. And only 38% of those polled can safely say that they always leave their house and car secure (closed and locked) without any valuables on view.

Even though the most recent statistics from the ONS show that the vast majority (81%) of incidents of vehicle-related theft occurred either during the evening or through the night, people are only slightly more cautious after dark. Alarmingly, a quarter (25%) admitted that they forget to lock their car overnight and just over one in ten (11%) are happy to leave valuables visible in their car overnight.

But, with only 24% of people being fearful of having their car broken into or stolen, it fits that prevention isn’t always front of mind. And it’s not safe to assume that today’s cars are hard to steal thanks to modern security technology.

According to the ONS, over half (53%) of vehicles stolen between April 2016 and March 2017 were less than five years old and almost one in five (16%) were under a year old. Having a new car clearly isn’t an immunity against crime and certainly doesn’t mean that your vehicle is thief proof; even today.

And when figures from the ONS show that nearly two thirds (60%) of all stolen vehicles between April 2016 and March 2017 were not returned to their owner, it’s even more concerning.

The best advice is to avoid making a criminal’s life easier by being smart about where you park, keeping valuables out of sight and simplest of all, making sure you always lock your car. A little extra vigilance will go a long way.

Not only is crime a real threat, but the aftermath can be a problem too. In fact, it isn’t just one big inconvenience, it’s a costly inconvenience!

ONS figures show that victims of car crime inevitably incur unplanned and pointless costs as a result. A massive 84% of people reported that, in the 12 months between April 2016 and March 2017, the cost of damage to their stolen vehicle was up to £500. These values aren’t insignificant and are in addition to the cost of the stolen vehicle itself.

Our approach to home and vehicle security can be all too casual; particularly when you consider that so many of those polled have actually experienced some sort of crime against their house or vehicle in the last 12 months. Furthermore, according to the ONS, almost half of all vehicles (49%) were stolen from ‘semi-private’ locations including outside areas and garages around the home.

The costs of car crime don’t stop there – criminals love valuables. A quarter of respondents have had technology items stolen from their car, just under one in five (19%) have had sentimental items such as handbags and gifts stolen and nearly one in eight

(12%) have had tools of their trade taken. These items will hold personal value and, like stolen vehicles, are unlikely to be returned.

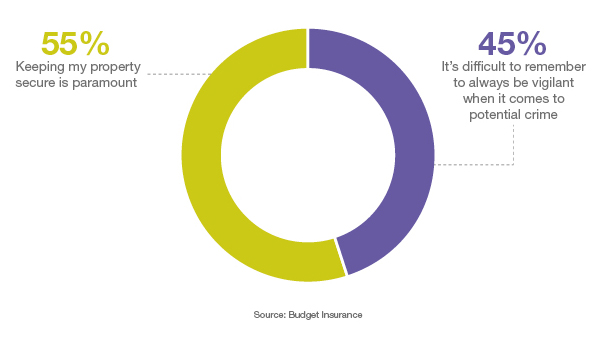

And it’s not just car crime that’s the problem. Only 55% of all those surveyed believe that securing their property is a priority. More than one in three (35%) admit to having left windows open in their house, while one in five (19%) has gone out of the house leaving the door open. This wouldn’t be so much of a problem if half of those surveyed didn’t go on to admit that they spend time worrying about their house being broken into. 12% of burglaries in the year to March 2017 were carried out by thieves getting through an unlocked door, and a further 8% due to open or unlocked windows (ONS).

It begs the question, why worry if you’re only going to leave an open invitation for criminals to enter? Protecting yourself, your house and your vehicle against crime needs to become second nature. Criminals work around the clock and so should your security.

Who should be fighting crime?

Given the clear concern over rising crime it’s remarkable that almost half of those who’d experienced theft or vandalism (42%) through the year chose not to report it to the police.

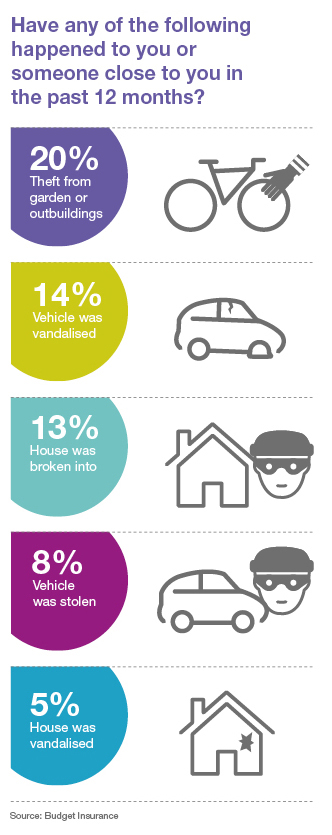

This is all the more surprising given the fact that 46% admitted that they, or someone close to them, had experienced crime in the last 12 months – including theft from garden or outbuildings, having their house broken into or having their vehicle stolen.

This may be another indication of our busy lifestyles and a lack of time to invest in crime prevention. Or perhaps we simply believe that our police forces are too stretched to be able to take effective action against property and vehicle crime.

For over a quarter of people, this is true. Over a quarter (28%) feel that, even if they reported a crime, the police wouldn’t do anything to help.

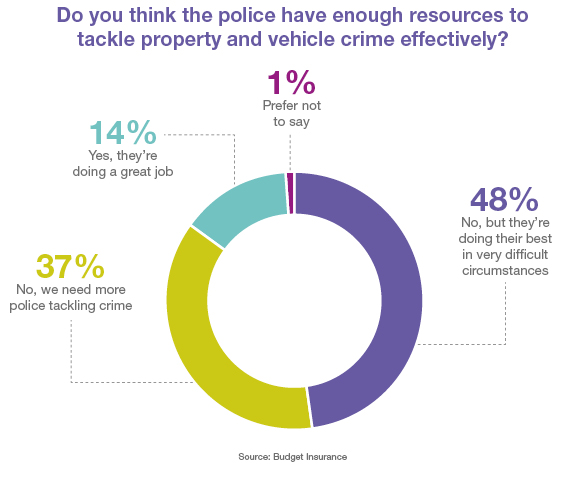

And this isn’t necessarily indicative of police capability, but more a sign of sympathy towards the tough role they face. A staggering 86% of people surveyed believe that police do not have enough resources to tackle crime effectively yet almost half (48%) believe that they continue to do their best in very difficult circumstances.

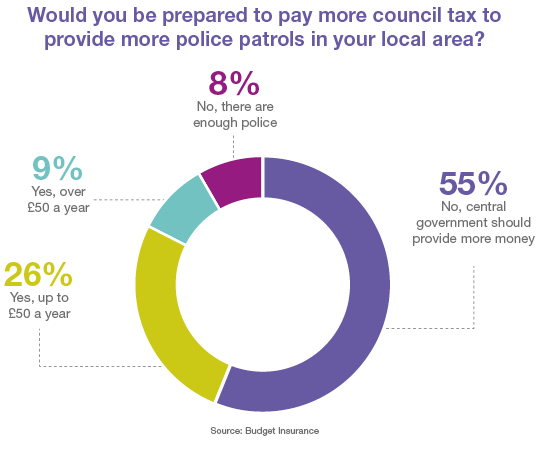

With that in mind, over a third of people said they’d be happy to pay more council tax to provide more police patrols in their local area – with 26% suggesting they would pay up to £50 a year extra, and 9% saying they’d pay even more than that.

Over half agreed that the police are overstretched, but feel the responsibility to provide more money for bobbies on the beat lies with central government. Just 8% of respondents feel there are currently enough police patrols.

Given stretched resources, one in ten people (9%) believe that the police should concentrate on catching more dangerous criminals; home and vehicle crime should not be their primary concern.

However, there may be a more selfish angle at play. Almost one in five (17%) state that reporting a crime is pointless because they’ll never get their belongings back anyway.

And, with police resources constantly suffering, this is simply another pressure to add to the list.

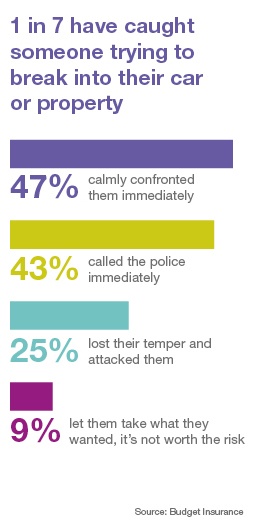

But it seems there are other reasons not to inform the police too. Some of those surveyed believe it’s easier to just take matters into your own hands; especially if you catch a criminal in the act. Nearly half (47%) of those who have witnessed someone breaking into their car or property have said that they confronted the criminal themselves. And, even less rationally, 25% thought the best option was to lose their temper and attack the thief.

It seems we’re largely a self-sufficient nation, but we shouldn’t let our pride rule. Taking the law into our own hands is not an advisable course of action – even if we are concerned about police resources.

Who should be fighting crime?

Some crimes are deemed too petty to report. And some people are too busy to be vigilant against crime.

It seems many of our lives are also too full to invest time and money in protecting our belongings.

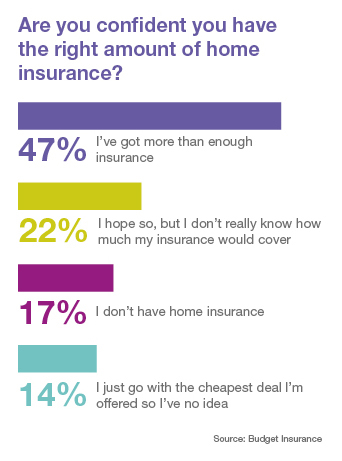

Worryingly over half of those polled (53%) admitted to either having no home insurance at all or having no idea about the type or level of cover that they have.

14% of people who do have insurance cover admitted that they were sold on the cheapest deal, meaning they have no real knowledge of whether or not they have the cover they need.

This is an area where greater prudence seems to come with age. The majority of over 60s (63%) are confident that they have more than enough insurance to cover their possessions; not just against burglary, but fire and flood as well – close to twice as many as the 16-29 age group, where the figure falls to 34%. Similarly, while 19% of those aged 30-44 say they just go with the cheapest deal they’re offered, only 7% of over 60s would agree.

It seems there’s room for education here: insurance is not a one-size-fits-all proposition, and it’s important that we take the time to think about what we have and buy the appropriate level of cover to protect us in the event of something going wrong. The Money Advice Service is a good source of information and has useful guides to buying home and car insurance.

The fear of crime is real and widespread. And although people’s worries aren’t all-consuming, there is an acknowledgement that concerns over crime can have an impact on our quality of life.

Even though a large proportion admit that keeping their property secure is not always a priority, a significant number of people (almost one in three) are losing sleep worrying about crime. And just over a third (34%) say that they have been made to feel afraid in their own homes.

Let us not forget the actual victims of burglary and vehicle theft, over 80% of whom are left with emotional consequences including anger and shock, loss of confidence and feelings of vulnerability, anxiety and even depression.

That said – and as realistic as we are about crime rates being on the increase – we continue to display a rather laissez faire attitude to crime prevention, even though 46% of people surveyed, or someone close to them, have been victims of crime in the last 12 months.

And, surprisingly, even though people are genuinely concerned that the police lack the full resources they need to catch criminals or recover stolen property, more than half of our survey respondents either have no insurance cover at all or don’t know whether their cover is sufficient.

Quite simply, developing a more cautious and proactive approach to crime could result in people having more control themselves.

Crime prevention requires an investment of both time and money. A prudent approach to security should always be a top priority and taking out sufficient home or car insurance is a necessity. To be properly prepared, and for peace of mind, people not only need to be aware of the threat of crime, but implement measures to protect themselves against it too.

Home security tips

Following a few simple steps can help to prevent burglars from targeting your home.

Get ready

- Create a mental checklist: check (and double-check) that you’ve turned off your hair straighteners and you’ve locked all windows and doors.

- Keep it tidy: don’t leave small valuables on show, take iPads, laptops and cameras upstairs. Hide your cash.

- Put on your best jewellery: but if you’re not wearing it, think of some creative hiding places to store it – that aren’t in the master bedroom. Try hiding it in a fake book on the book shelf, in an envelope taped under the dresser or in the back of the filing cabinet hidden amongst the admin!

- Set your house alarm: every time you leave even if it’s just for half an hour. It forms a habit and stops you forgetting.

- Remember your keys: walk out of the house with your keys in your hand (it reminds you to lock the door). Don’t leave a spare under the mat and if you’re taking a taxi, don’t tell the driver how long you’re planning to be out!

Keep up appearances

- Dress your house up: make it look lived in; even when you’re away. Leave a few things scattered around, toys on the floor or an open book and a pair of glasses on the arm of the sofa.

- Keep them guessing: make the place look active and lived in. Invest in a smart plug so you can turn your lights on and off regularly, and time the radio to play in the evening.

- Pretend you’re around: curtains are a giveaway. Ask a friend to pop by to open and close them occasionally. Even get them to park on your drive overnight; everyone likes a bit of ‘company.’

Find your friends

- Nosey neighbours have their benefits. Establish your ‘team’ of trustworthy neighbours to keep an eye on things while you’re away. There’s strength in numbers!

- Remember Home Alone? Create your own effect. Ask someone to remove your post from the letter box, put the bins out and give the impression that someone is still at home.

- Let there be light: Install a motion-activated security light and get your team of nosey neighbours on the lookout for any unusual activity.

- Have a game plan: leave your contact number and a spare key with someone in case of an emergency (not when you need to get in at 3am!).

Motor security tips

Stolen car is more than just an inconvenience, so take steps to keep it (and its contents) safe:

Don’t make your car vulnerable

- Keep valuables out of sight either in the glove box or the central console.

- Keep coins tidy and preferably in your pocket or handbag along with your wallet.

- Invest in a closed ‘kit’ box for the boot to store larger items such as sat-navs and DVD players until you need them.

- Even bags, coats and jumpers should be out of view: thieves use these to conceal other items as they make their escape.

- Invest in some extras: Locks for your steering wheel gearstick or pedals can make a thief think twice.

- A simple tracking device will increase the chances of you getting your car back if it is stolen.

Take care of its location

- Be cautious about where you leave your car: do some advanced prep and choose a car park carefully.

- Look out for somewhere that is well-lit and monitored by CCTV.

- A busy location with lots of traffic and plenty of pedestrians is a good deterrent.

- A security light on your own driveway is a good alert for unwanted company – as is a small home CCTV system.

- If you have the option, put your car in a garage overnight away from prying eyes.

Create a car routine

- Even if your car is on the drive, make sure it’s secure by closing the windows and locking the doors, check and double-check by pulling the door handle before you walk away.

- Once in the house, keep your car keys out of sight from doors and windows – it could prevent someone breaking in.

- Check the weather forecast in winter and set your alarm 10 minutes early to stay in the car while you de-ice on frosty days.

Crime prevention tips

Be ahead of the game in preventing crime…

Understand your insurance

- It may seem dull and time consuming, but knowing your options will mean you choose the most appropriate cover for your house and car.

- Set an annual diary reminder (and don’t delegate the task!) to review your cover and ensure you’re always getting the best deal.

Investigate extra security measures

- Look to install additional controls such as alarms, immobilisers and trackers. All deter thieves and help keep premiums down.

- If you have a large property, lots of outside space, live off the beaten track or have a collection of valuable vehicles, CCTV should be your new best friend.

Report crime

- It may mean a lengthy phone call to the police or even a trip to the police station, but police awareness improves the chances of retrieving your goods and may prevent it happening to someone else.

- Make sure you keep a record of your crime reference number if you’re looking to make an insurance claim.

Be cautious with social media

- Keep track of social media connections and take care when accepting new friendships.

- Don’t spread yourself too thin; limit your social media accounts to people you know and check your privacy settings.

- Post those holiday snaps when you get home; not while you’re still away.

- New car, phone, jewellery? Think twice before sharing; you wouldn’t take an ad out in the local paper to show off, would you?